ev tax credit 2022 infrastructure bill

The bill would provide 75 billion for zero- and low-emission buses and ferries aiming to deliver thousands of electric school. White House National Climate Advisor Gina McCarthy expressed confidence on Thursday that tax credits for electric cars would.

Latest On Tesla Ev Tax Credit March 2022

And while it is a non-refundable credit ie.

. Heres whats in the bipartisan infrastructure bill. Many EVs these days have a 100 kWh. For example if you owed 5000 in federal taxes and received a 7500 federal tax credit for buying an electric car your taxes would be reduced to 0.

The United States Electric Vehicle Tax Credit is one of the most notable advantages of purchasing a battery-electric car. In the new language SUVs trucks and vans with a manufacturers suggested retail price of up to 80000 can qualify for the credits. What truly stands out in this approved bill is the 75 billion promised to.

The base credit goes up by 4500 if the vehicle. Lexus ES overview. Posted on August 11 2021.

Its a massive boost from the original. This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial property and 1000 for a primary residence. A Made in America EV tax credit what car buyers need to know if Biden can advance a sliced-and-diced Build Back Better bill Provided by Dow Jones Jan 24 2022 742 PM.

For this purpose the bill provides a 7500 tax credit to anybody who buys US-made electric vehicles starting 2022 till 2026. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. The full EV tax credit will be available to individuals reporting adjusted gross incomes of 250000 or less 500000 for joint filers decreased from 400000 for.

The bill also contains a 10 percent tax credit of up to 2500 for road-legal electric two- and three-wheeled vehicles capable of going faster than 45 mph 72 kmh. EV made with union labor. A maximum 12500 federal EV tax credit including a bonus for union-made vehicles appears to have survived the negotiation process and is now a likely part of the.

Marie Sapirie of EEs Tax Notes group reports on some potential big developments for the US. January 20 2022 1151 AM PST. With electric vehicles gaining traction the Biden administration is advocating expanding and updating the EV tax credits as part of its effort to foster the development of.

As the bill is currently written a maximum credit of 12500 would go to consumers who purchase a domestically manufactured US. It cannot be used to increase your overall tax refund it is still a. Electric cars and trucks made by nonunionized shops were eligible for 7500 in incentives.

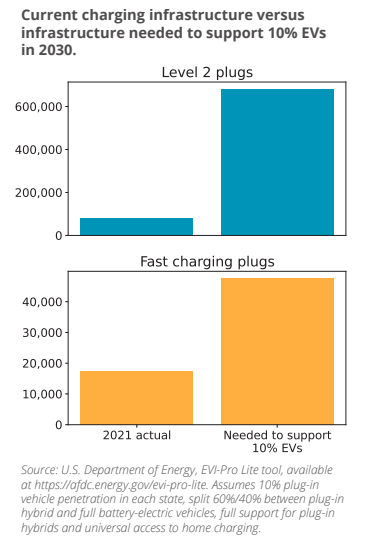

The bipartisan Infrastructure Investment and Jobs Act provides 75 billion to jump start Bidens goal of having 500000 EV charges nationwide by 2030. Still you would not receive. Another blow to the infrastructure bill is that the Build Back Better bill was put on hold as legislators attempt to lower costs.

There is a federal tax credit of up to 7500 available for most electric cars in 2022. The main 7500 tax benefit shifts from tax credit to refund and is for vehicles with batteries of more than 40 kilowatt hours meaning virtually every EV on sale now. The 7500 check sent to.

An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold. Congress considers EV tax credit revamp to help Tesla GM and used EVs. The used EV tax credit takes effect January 1 2022 and expires December 31 2031 and has an income-based phaseout of 200 for each 1000 of a taxpayers modified.

The bill also offered record incentives for used electric cars and it would have. The bill has proposed to. Its inclusion comes as the bill sheds multiple.

Latest On Tesla Ev Tax Credit March 2022

Charged Up For An Electric Vehicle Future Illinois Pirg

Electric Vehicles Charge Ahead In Statehouses Energy News Network

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers

Reconciliation Proposals Support Both Electric And Hydrogen Vehicles Third Way

The Infrastructure Plan What S In And What S Out The New York Times

Latest On Tesla Ev Tax Credit March 2022

Joe Manchin Is Blocking The Electric Vehicle Tax Credit Protocol

The Infrastructure Bill Moves Forward Why It Doesn T Really Help Tesla Stock Barron S

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

What Does The Infrastructure Bill Mean For Ev Charging Ev Connect

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Congress Passed The Infrastructure Investment Jobs Act What Does This Mean For Investors Global X Etfs

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Are Ev Tax Credits Back On The Table Maybe E E News

The Infrastructure Bill Moves Forward Why It Doesn T Really Help Tesla Stock Barron S

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News