dallas county texas sales tax rate

Texas Comptroller of Public Accounts. Name Local Code Local Rate Total Rate.

Amazon Fba Sales Tax Made Easy A 2022 Guide

Dallas collects the maximum legal local sales tax The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

. Tax Office Past Tax Rates. Click any locality for a full. 100 rows Dallas County is a county located in the US.

The December 2020 total local sales tax rate was also 6250. Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas County TX is 6250. 2022 Texas Sales Tax By County Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales tax.

Dallas County is a county located in the US. Records Building 500 Elm Street Suite 3300 Dallas TX 75202. There is no applicable county.

The Dallas County Tax Office is committed to providing excellent customer service. The combined sales tax rate for Dallas County TX is 725. Dallas collects a 0 local.

As of the 2010 census the population was 2368139. Get rates tables What is the sales tax rate in Dallas Texas. This is the total of state and county sales tax rates.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas. 214 653-7811 Fax. 1639 rows 7934 Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2.

The minimum combined 2022 sales tax rate for Dallas Texas is. Texas has six metropolitan transit authorities MTAs two city transit departments. This is the total of state county and city sales tax rates.

Groceries are exempt from the Dallas and Texas state sales taxes. Contact each city directly for property zoning information and lien releases for tax foreclosed properties. 214 653-7811 Fax.

Transit Sales and Use Tax rates. Dallas County Texas Sales Tax Rate 2022 Up to 825 Dallas County Has No County-Level Sales Tax While many counties do levy a countywide sales tax Dallas County does not. It is the second-most.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. It is the second-most populous county in Texas and the ninth. There are a total of 998 local tax jurisdictions across the.

Records Building 500 Elm Street Suite 1200 Dallas TX 75202. The December 2020 total local sales tax rate was also 8250. The Texas state sales tax rate is currently 625.

Contact the Customer Care Center at 214-653-7811 Monday through Friday from 800 am. Dallas TX Sales Tax Rate The current total local sales tax rate in Dallas TX is 8250. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

As of the 2010 census the population was 2368139.

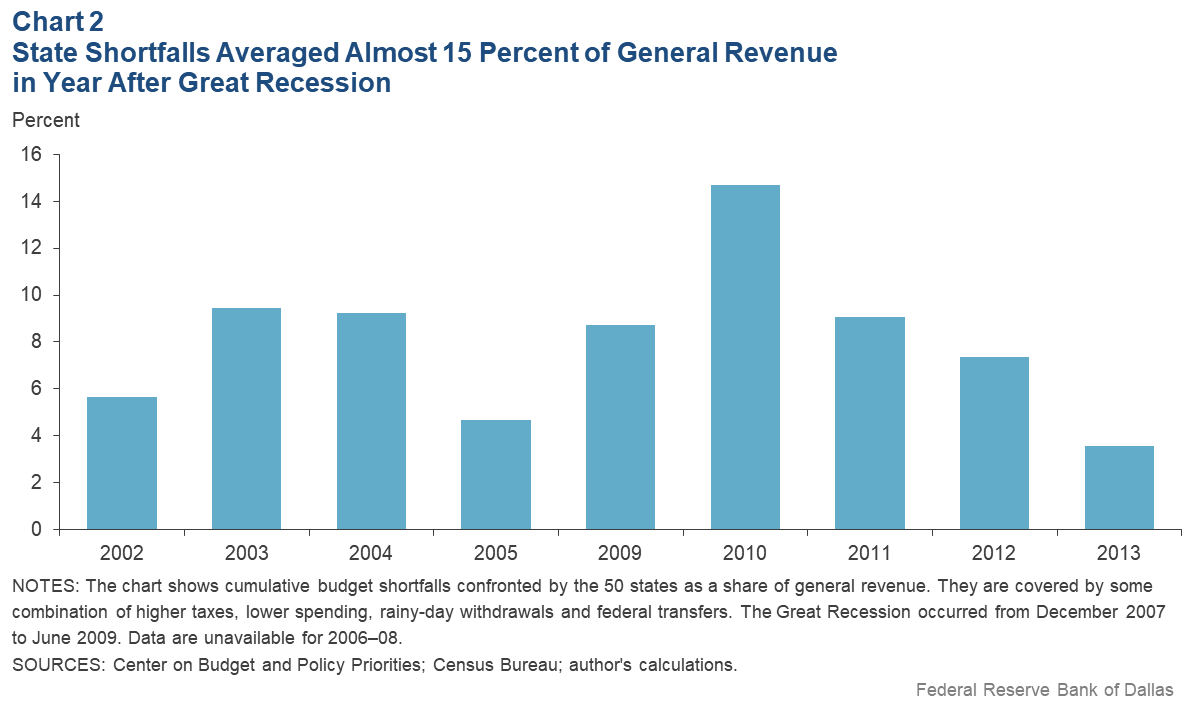

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Dallas Dfw Property Tax Rates H David Ballinger

Public Works Property Division Tax Foreclosure Resales

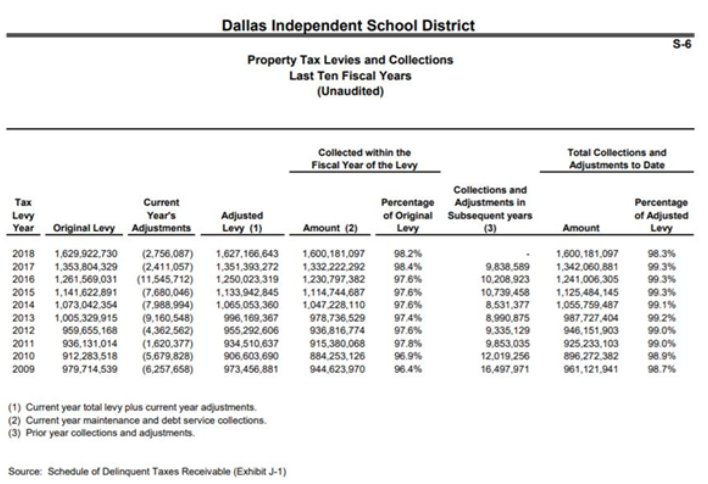

Property Taxes Already A Problem In Dallas Isd

Texas Sales Tax Holiday On School Supplies Planned For Aug 5 7 Community Impact

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Texas Sales Tax Exemption Certificate From The Texas Human Rights Foundation Unt Digital Library

Texas Sales Tax Small Business Guide Truic

Property Tax Rate Frisco Tx Official Website

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Texas Sales Tax Guide For Businesses

Texas Sales Tax Rates By County